ZATCA e-invoicing - Phase 2

February 11, 2024

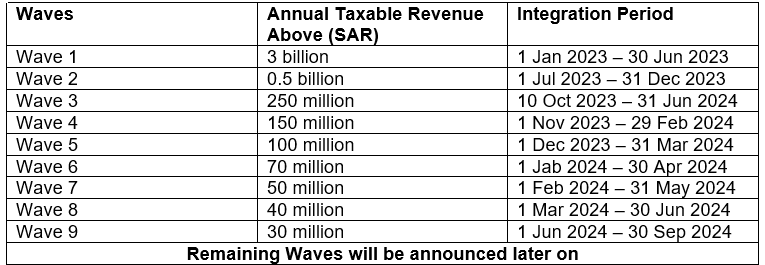

ZATCA announced the waves for phase 2 of e-invoicing in Saudi Arabia as follows:

What is the process flow for phase II KSA e-invoicing?

Businesses subject to e-invoicing requirements must connect their ERP/POS/accounting software to ZATCA's system. According to the e-invoicing resolution, standard tax invoices must be processed instantly, while simplified tax invoices need only be reported within 24 hours of creation.

Onboarding of a new E-invoicing Generation Solution (EGS) Unit

- Taxpayer accesses Fatoora Portal through dedicated website.

- Taxpayer logs into Fatoora Portal (ERAD).

- Taxpayer is redirected to the Fatoora Portal.

- Taxpayer inputs how many OTP Codes they would like to generate (based on the no. of devices to be onboarded).

- Fatoora Portal displays the OTP codes.

- Taxpayer enters the OTP codes on their solution unit(s) / devices(s).

- Taxpayer’s device (s) send request for cryptographic stamp identifier (s) to the Fatoora. Platform (containing all the necessary information as per the security features) along with OTP from solution / device.

- Taxpayer’s solution unit (s) / device (s) undergo the necessary compliance checks.

- Fatoora Platform sends the request to ZATCA CA for the cryptographic stamp identifier(s).

- ZATCA CA generates the cryptographic stamp identifier(s) for each taxpayer solution unit / device.

- Taxpayer solution unit (s) / device (s) receives new cryptographic stamp identifier.

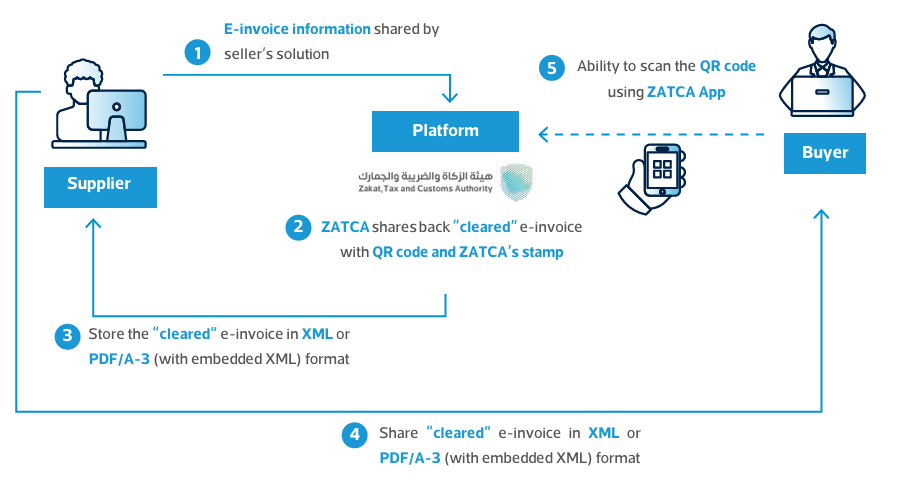

Standard tax invoice generation flow in phase 2

By following below steps, you can effectively manage the real-time clearance of tax invoices and associated documents in compliance with regulatory requirements:

- Integration Setup:

- Ensure that your ERP/POS/accounting software is integrated with the tax authority's system (e.g., ZATCA).

- Set up the integration to facilitate real-time transmission of tax invoices.

- Initiate Invoice Transmission:

- Once an invoice is generated within your system, initiate the transmission process immediately.

- Send the electronic invoice directly to the tax authority before sharing it with the buyer.

- Validation Process:

- The tax authority validates the received tax invoice across various categories.

- Validation criteria may include compliance with tax regulations, accuracy of information, and authenticity of the invoice.

- Approval and Stamp:

- If the tax invoice passes the validation process, it is stamped by the authority.

- The stamped invoice is then returned to you, confirming its approval.

- Sharing with Buyer:

- After receiving the stamped invoice from the tax authority, share it with the buyer as per usual business practices.

- Scope of Clearance:

- This clearance process applies not only to tax invoices but also to associated credit/debit notes.

- Ensure that all relevant documents are processed through the real-time clearance system.

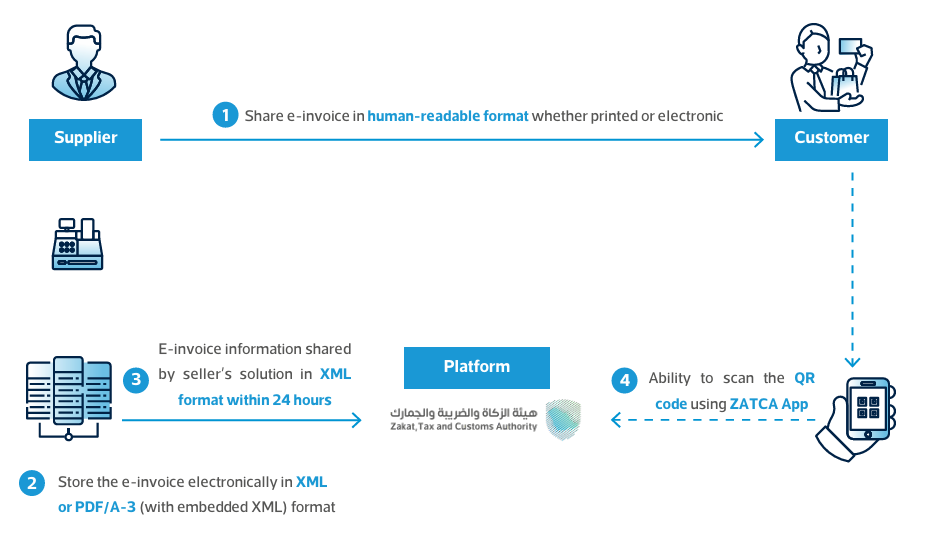

Simplified tax invoice generation flow in phase 2

By following below steps, you can effectively manage the reporting of Simplified Tax Invoices and associated Credit/Debit notes within the specified timeframe and in compliance with regulatory requirements outlined by the tax authority.

- Upload to FATOORA Portal:

- Within 24 hours of issuance, upload Simplified Tax Invoices and their associated Credit/Debit notes to the FATOORA Portal.

- Ensure that the uploaded documents comply with the requirements outlined by the tax authority.

- Validation Process:

- Once uploaded, the Simplified Tax Invoices undergo validation.

- This validation process verifies compliance with regulatory standards, including the use of compliant E-Invoice Solutions.

- Acknowledgement via API:

- Upon successful validation, an acknowledgement is sent back to the taxpayer through the API.

- This confirmation serves as a receipt of the submission and validation of the Simplified Tax Invoices.

- Stamping by E-Invoice Solutions:

- Simplified Tax Invoices must be generated using compliant E-Invoice Solutions.

- These solutions are responsible for stamping the invoices in accordance with the requirements specified by the tax authority.

- Compliance Check:

- Ensure that all invoices and associated documents meet the Controls, Requirements, Technical Specifications, and Procedural Rules outlined by the tax authority.

- This includes adherence to the E-Invoicing Regulation and subsequent resolutions.

E-Invoicing Record Keeping

Taxable persons must adhere to the record keeping requirements of Electronic Invoices, Electronic Notes and its associated data, and any other requirements as per the applicable laws and regulations.

Microsoft 365 Add-on for ZATCA compliance

Add-on specifically designed to provide businesses with the tools they need to stay compliant. With the Microsoft 365 e-Invoicing Add-On, businesses can easily create, send, and track invoices in real-time, ensuring that they meet all the requirements set forth by ZATCA for Phase 1 and Phase 2.

Contact us to know more and seamlessly integrate with ZATCA portal